PROJECT DESIGN & PRE-DEVELOPMENT

- Pre-Land Acquisition Project Pro-Forma preparation is absolutely critical, as need to ensure satisfactory and attainable profit is available.

- Visit prospective site to familiarize oneself with all site specifics (neighboring properties, existing to demolish, loading/off-loading access during construction, overhead hydro lines, crane swing impediments, lane and sidewalk potential closures, hours of work restrictions, proximity of any subway lines for vibration controls etc.)

- Research comparable sales thoroughly to assess revenue capability – suites, parking stalls, storage lockers, guest suites, closing adjustments, any ground floor retail.

- In-depth analysis with developer, architect, municipal lawyer on likely zoning and density approval including setbacks, floor plate sizes, building height.

- Parking – assess parking requirements as well as parking grid efficiency layout to arrive at parking floor area needed. Discuss and agree use of shared cars (e.g. ZIP cars) to minimize stall count.

- Bike Lockers – assess and understand bike locker requirement

- Mechanical/Electrical Support Space – as likely that no mechanical/electrical engineer yet retained, research comparable projects for projected mechanical/electrical support space needed and allow for some

- Prepare realistic project schedule for planning approvals, marketing and pre-sales, design, construction and warranty period. Allow for required escalation, where necessary.

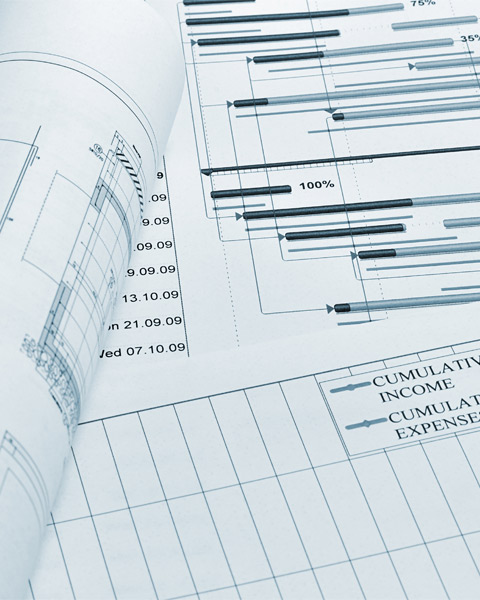

FEASIBILITY STUDIES & PROJECT PRO FORMAS

- Agree project statistics to be used for pro forma – gross floor area residential and parking, suite count, parking stall count.

- Prepare project pro forma including detailed Project Budget (+/-70 items), full Division 16 trade estimate, Revenue, Source of Funds, Cash Flow optional

- Assess Source of Funding required to finance project including Insured Deposits, Deferred Costs, Construction Loan, Cash Equity, and any Land Surplus Equity option

- Calculate IRR (internal rate of return) where required

- Advise on Equity Investor availability, possible JV partners, acceptable Management Fees, Mezzanine Lending options

COST ESTIMATING

- Preparation of Detailed Construction Budget on a trade-by-trade basis as well as detailed site overheads

- Value Management of design

- Comparing, reconciling and agreeing common budget with Construction Manager

- Agreeing Site Overheads with Construction Manager

- Review and approval of list of tendering trade contractors

- Advise on any bonding requirements

- Preparation of sum insured for All Risks Insurance for both construction and re-incurable soft costs

- Client advice on project procurement; tender documentation preparation, analysis and management, contractual documentation preparation, review and management

- Assisting, participating in trade interviews pre-contract award

- Agreeing Schedule of Values for agreed contract price

- Approving monthly payment invoices from trades as well as site overheads and all soft costs

- Site visits at month-end to establish work completed

- Ongoing Proactive advice on Project Pro Forma maintenance

ADVISORY ROLE

- Reporting on desired expectations from sales team regarding suite layouts, building amenities, quality of finishes with object of balancing ability to sell project with cost forecasting and control in order to maintain pro forma profit to ensure a successful project

- Preparing Sensitivity Analyses on various design options (budget -v- revenue to ensure profit satisfactory)

- On-going monitoring of construction market conditions to ensure pro forma pricing remains on target. Adjust and report as necessary where revisions needed.

- Monitor individual trade availability, and where specific trades becoming increasingly expensive, advice on alternatives (e.g. increasing precast costs perhaps switch to masonry).

- Advice on use of pre-fabricated materials to mitigate against winter season delays e.g. off-site pre-fabricated precast wall panels instead of in-situ site installed brick.

- Engage early with preferred trade contractors to interest them in project with intention of ensuring competitive and preferred pricing.

- Constantly monitoring of City/Region related charges and legislation changes for Development Charges, Parkland, HST, Section 37, Realty Taxes, Building Permit fees, Site Plan Applications fees, Green Roofs, DC credits for improved green standards.

- Advising Developer on all material consultant soft cost awards.

- Advising on Purchaser Deposit structure as it relates to maximizing for Source of Funds for overall project budget funding purposes.

- Reporting to Deposit Insurer on any early release of deposits to fund pre-development costs

- Reporting to Pre-Development Lender, if applicable including certification of monthly costs for loan advances

- Preparing detailed Pro Forma submissions for Construction Lenders and meeting with Lenders to discuss project as Lender requires

- Working with Developer where required to appoint suitable Construction Manager

PROJECT MONITORING & LENDER SERVICES

- Ongoing monitoring of sales including approving all pre-sales, where required

- Loan Monitoring on behalf of Construction Lender (1st mortgagee) & Deposit Insurer (2nd mortgagee) including

(i) Preliminary Report preparation;

(ii) Monthly Progress Reports

(iii) Sales & Leasing Review

(iv) Margin Loan Advance calculation

(v) Cash Flow monitoring and maintenance

- Change notice review and recommendation, where required

- Anticipation of and assessment of Contractor Claims and giving advice on avoidance, resolution and settlement of disputes, including negotiating with interest parties

Reporting to Co-Owners & Investors as required

- Establish and track project budget cost to complete

- Loan progress draw approval

- Insured deposit advance approval

- Confirmation of borrower’s equity contributions

- Review of construction contracts and other forms of commitments

- Payment certification under construction contracts

- Certification of hard and soft costs incurred

- Advanced margin calculations

- Confirmation of payments to project vendors from previously advanced loan amounts

- Development schedule review

- Cash flow projections

- Lease reviews

- Confirmation of qualified pre-sales per lender criteria

- Reviews of all material financial project documentation

- Confirmation condition precedents have been satisfied

- Periodic Site Visits

OTHER SERVICES

Condominium Post Registration

- Waterfall – reporting on distribution of sales proceeds to Co-Owners based on agreed Waterfall including typically in following order:

a) Full payment of construction loan including any required security for outstanding Letters of Credit

b) Retention of cash security in condominium lawyer deposit trust account for Tarion warranty requirements

c) Retention of funds to cover cost-to complete items including any remaining holdbacks

d) Payment of equity, including identifying any preferred equity

e) Payment of any preferred interest to equity investors

f) Payment of residual profit split